Week 3 - Individual investors

-

Transaction cost:

- commission/fees to brokerage

- bid-ask spread:

- when buying, pay ask price

- when selling, pay bid price

-

overview of individual investor performance

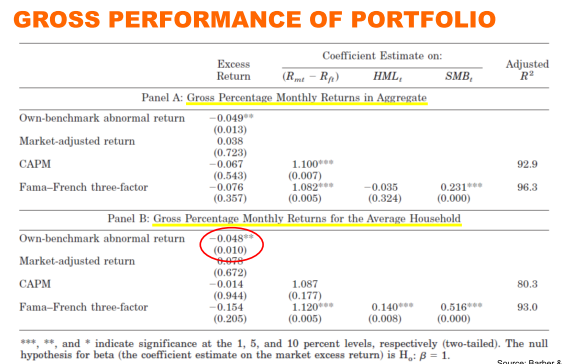

- in

()= p value. only stat. significant if < 0.05 - average household: benchmarked against simpling holding: no difference

- CAPM: no difference

- 3-factor - alpha also not stat. significant

- tilt towards value (positive coeff)

- tilt towards SMB (institutional tend to do more large stock) - which tends to have higher bid-ask spread -> more transaction cost

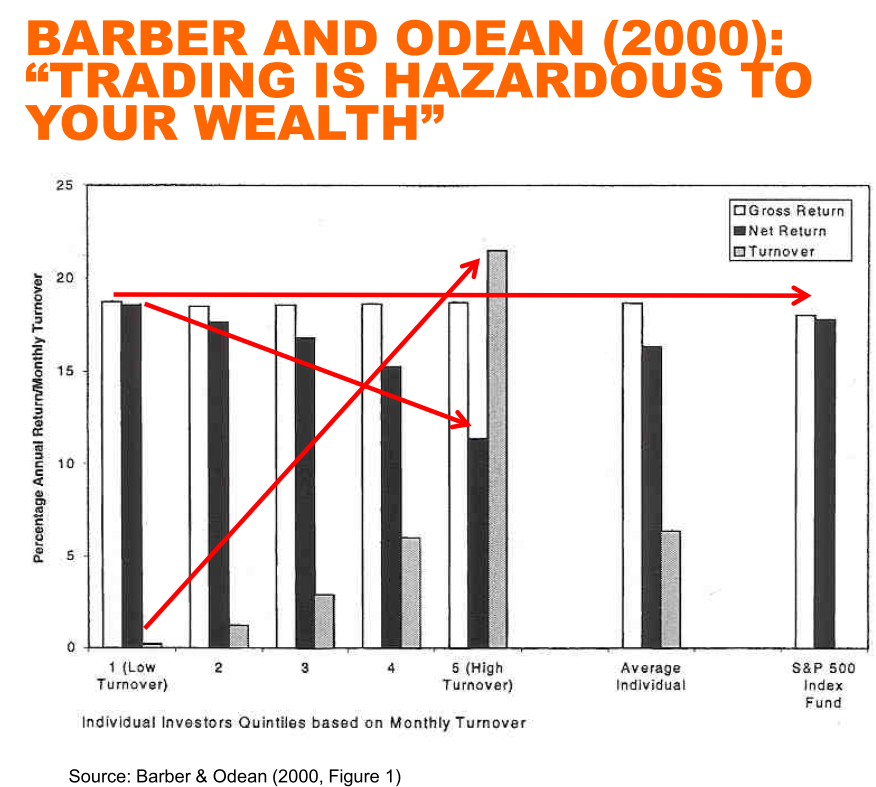

- in

- once taken into account of transaction cost, average household under perform against the benchmarks

-

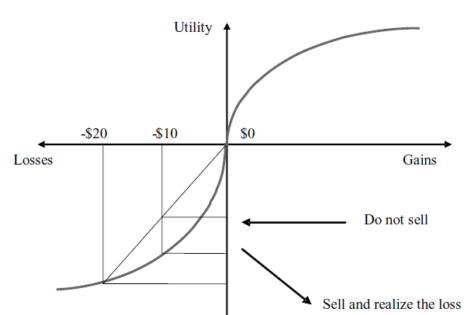

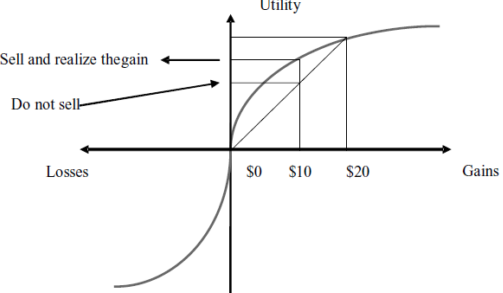

loss aversion

- assymetry:

- tend to hold on to stock with losses (expected utility of selling is worse than holding)

- tend to capture gains

- tend to hold on to stock with losses (expected utility of selling is worse than holding)

- loss-aversion good or bad?

- go against momentum effects

- against tax incentives

- loss aversion effect is stronger in tax-deferred accounts (in regular accounts, the tax incentive reduces the loss aversion effect) - so tax motivation still matters

- personal connection to asset

- emotional connection: house

- Genesove and Mayer(2001):

- if house has fallen value since purchase:

- takes longer to sell

- effect 2x for owner-occupants

- if house has fallen value since purchase:

- having someone to blame affects trading

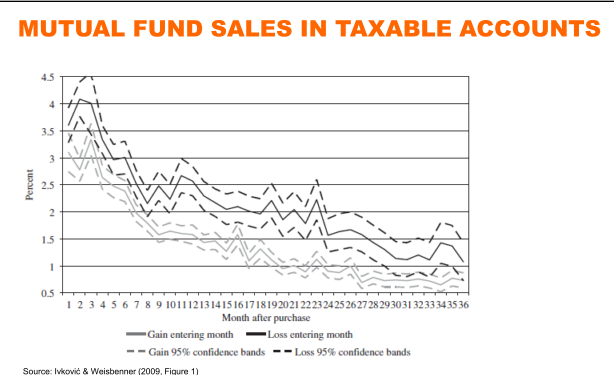

- effect is reversed for mutual funds - loss -> more likely to sell - tax effect more important, easy to blame the fund manager

- impact on corporate finance decisions

- firm acquisition:

- offer's chance of success jumps discontinously when offer price exceeds past 52-week peak

- equity issuance (sell stock to raise cash):

- influenced by the stock price when a CEO joined the firm -> suggest a firm with past poor stock return may need to fire current CEO if they wish to raise cash by selling equity

- firm acquisition:

- explanation for momentum?

- when the stock goes up with good news, the cashing-in effect dampens the initial price increase

- when stock goes down with bad news, the hold effect dampens initial drop

- Importance of endowment effect

- endowment effect:

- people given coffee mug and asked if they would trade it for chocolate. 89% keep the mug

- initially given chocolate, only 10% wants to trade it for mug

- given both choices at start, 56% choose mug

- tax witholding

- emotion on tax day: less upset with the witholding model

- benchmark: after-tax income

- credit card

- current vs future wealth

- annuities

- current wealth vs future consumption

- endowment effect:

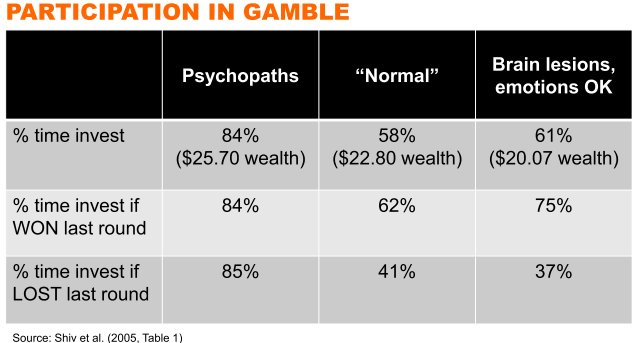

- emotions and financial decisions

- are psychopaths best investors? - shiv, et al 2005

- factors:

- loss aversion: more likely to invest after losing last round

- house-money effect: more likely to invest after winning

- representatives: more likely to invest after winning

- factors:

- are psychopaths best investors? - shiv, et al 2005

- assymetry:

-

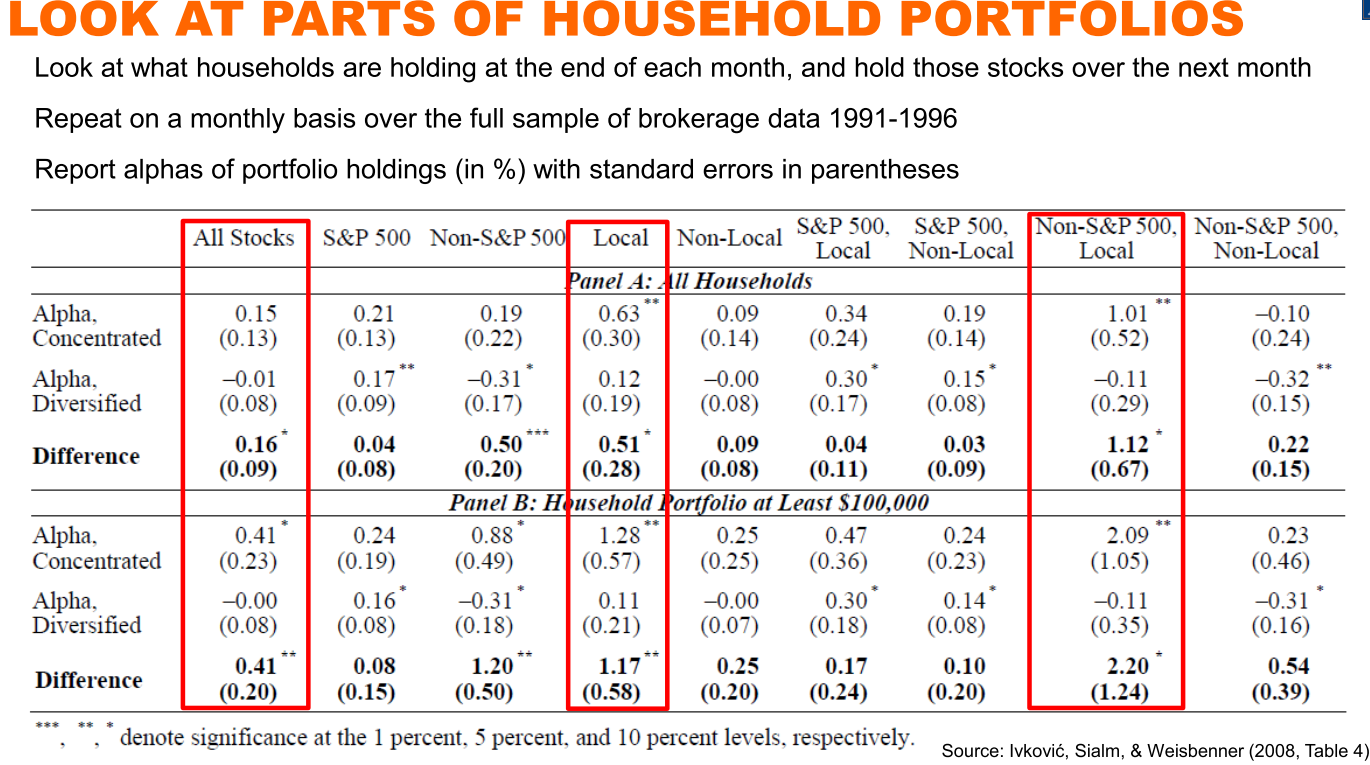

Skill of individual investors?

- local investments

- on average, household allocate 1/3 to local stocks (hq within 250 miles) vs 1/8 if spread evenly

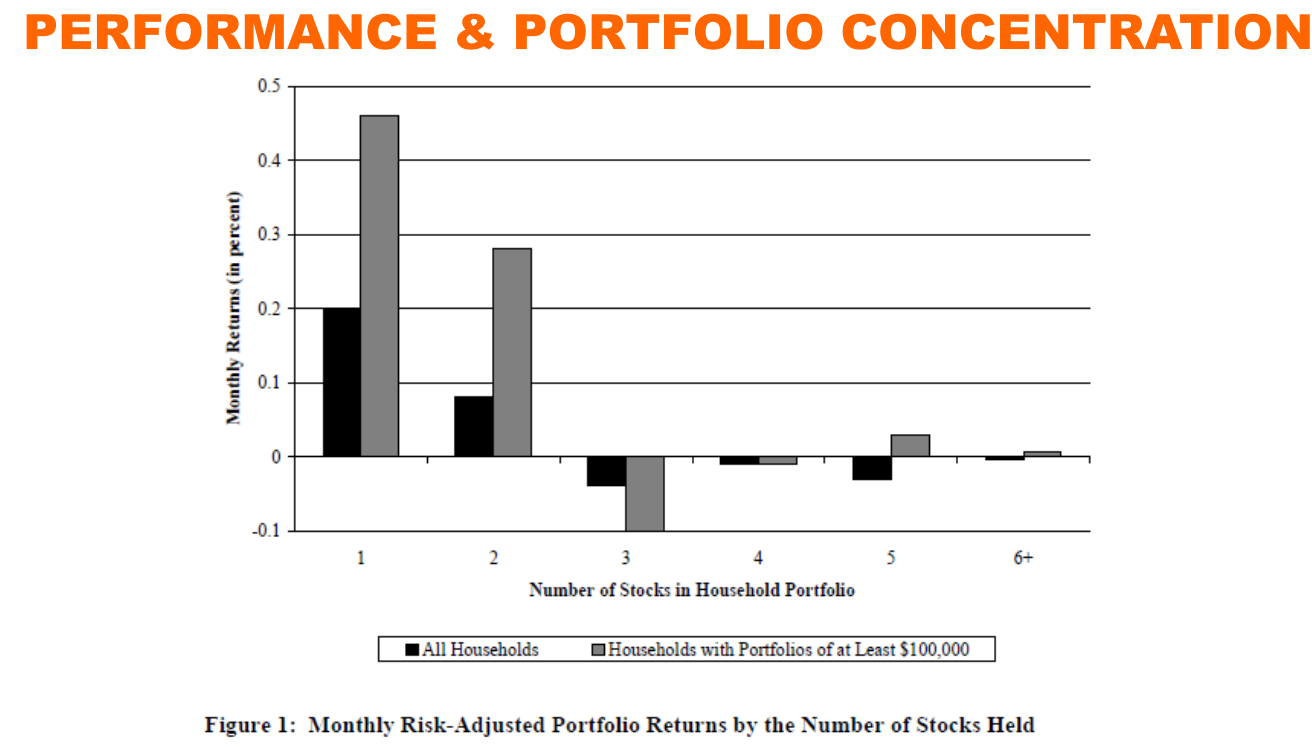

- concentrated accounts with 1 or 2 stocks (especially wealthy households) seems to have better information than more diversified:

- various robustness tests

- after excluding stocks with certain characteristic, result still hold

- various robustness tests

- local investments